A huge number of customers succumb to fraud to tax-related data every year. In case it transpires more workers inside your business organization, the results are even worse than getting deferred refunds. Whoever is influenced by this kind of data theft will burn through numerous hours of record administrative work, sending messages, making calls, etc. to get out of such a disastrous situation. This additional paperwork, along with the worries of encountering an exceptionally huge personal incident prompts, would harm the employee's performance on the work front too. It can lead to lost efficiency and even self-doubt.

Tax data theft can happen anywhere be it at home or your workplace. Cybercriminals directly target the Human Resources and finance departments to get the company's financial data. This can be done through W-2 phishing messages or emails, con artists calling your workers professing to be someone to who you would give out the information to. Their deeds are well planned, and there are full chances of you falling prey to them if you do not exercise safety measures and careful treatment of tax-related data. Nonetheless, there are three particular ways that

Human Resources and supervisory groups can help guarantee that their workers securely document their tax data.

- Educating the Employees about the possible risks and safety measures

- Spread conscious awareness about the possibility of such incidents among the employees

- Offer certain incentives to the employees if they abide by the security regulations and deadlines provided

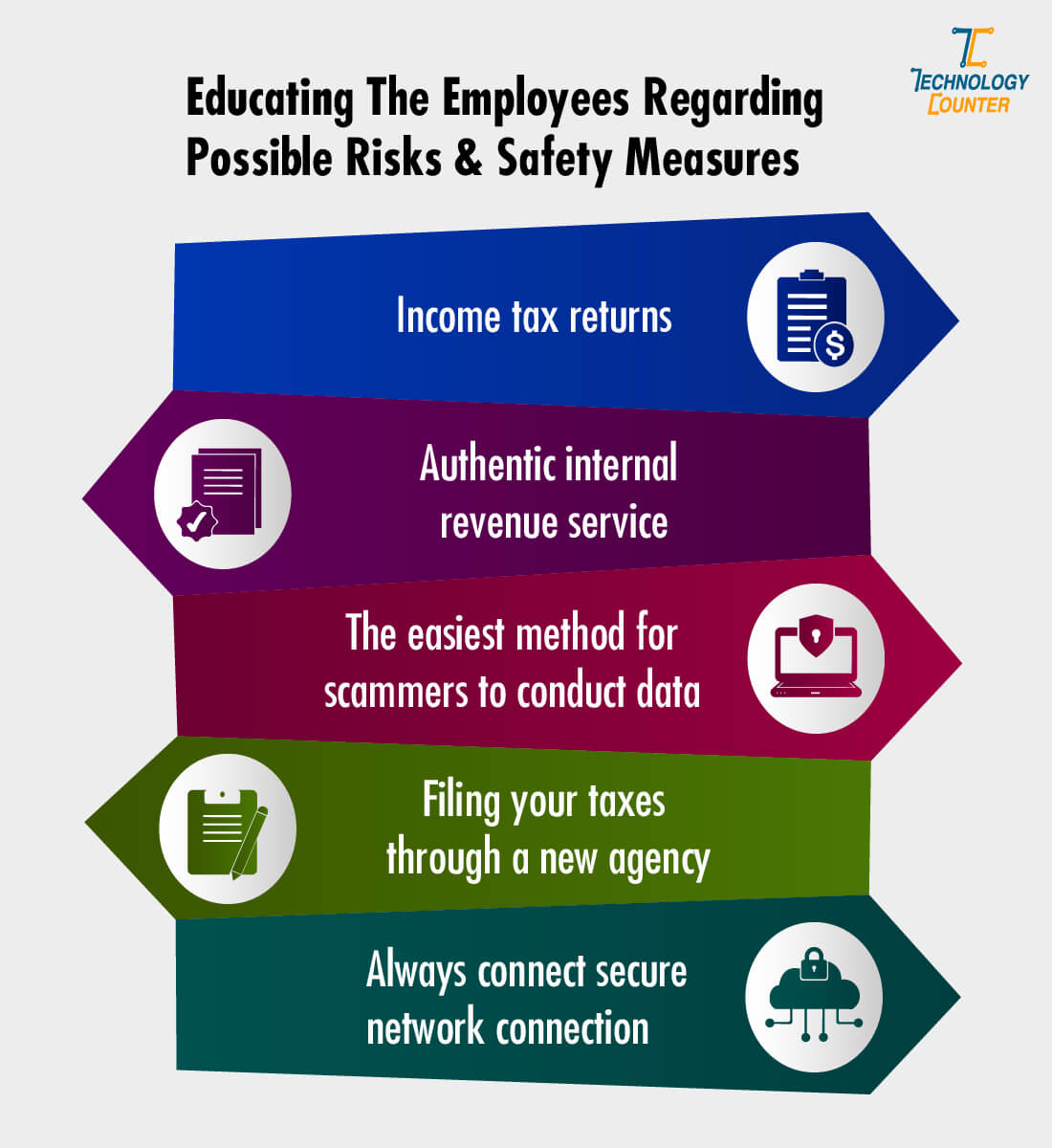

Educating the Employees About the Possible Risks and Safety Measures

The individuals working in the Human Resource Management, Finance, and accounting departments stand at the highest risk of tax-related data fraud. What's more, in the case that they fall prey to the trick of the thief, they can uncover a huge amount of crucial data and put the employees of the business organization at risk, all at once.

Coordinating with individuals from the Information Technology and Information Security teams to train the employees on how to avoid this kind of data theft is the best possible help you can offer. Educate them on the possible instances which can lead to data fraud and train them to distinguish a fraudulent message or email from a regular one.

From the viewpoint of the entire organization, share the best safety methods with workers on how they can maintain a safe distance from falling prey to any kind of tax-related data theft on an individual level.

Here are five points that should definitely be kept in mind.

- Document your income tax returns as ahead of schedule as you can. Also, it is always advisable to file them through an electronic medium if feasible.

- Authentic and genuine Internal Revenue Service never communicates through electronically generated mail. In case any employee receives one, instruct them to delete it then and there to avoid any chances of data theft.

- The easiest method for scammers to conduct data fraud id through phone calls. You must not provide any tax-related or financial information on a phone call, even if the person on the other side says that they are a part of the organization. Always verify your identity and only then share your data with someone.

- On the off chance that you are filing your taxes through a new agency or payroll software, you must always verify the authenticity before providing them any data of yours.

- You must always be connected through a secured network connection at the time of filing your tax returns. This can avoid various chances of tax data fraud with any individual or organization.

Spread Conscious Awareness About the Possibility of Such Incidents Among the Employees

It must be noted that all cases of tax data fraud do not take place online. Most low-budget scammers still use cheap methods like fraud calling, email fishing, email attachments with viruses, etc. to conduct such crimes and acquire the financial data of any individual. Whenever you are sending out the W-2 forms in the organization, make sure that you inform all your employees about the same. In such a scenario, they can immediately raise a complaint in case they do not receive theirs, and hence prompt action can be taken to safeguard the employee's data.

Making employees aware is extremely important. But there is one thing that is even more important. It would be best if you kept yourself aware of the methods and techniques used by the scammers to avoid any incidents of data theft. Always keep yourself updated, and then you can update the employees about the same. The Internal Revenue Service refreshes its customer alarms typically from time to time, depending upon the reports they get from individuals and law enforcement organizations.

Offer Certain Incentives to the Employees If They Abide by the Security Regulations and Deadlines Provided

Numerous business organizations have started giving valuable advantages to ensure that employees are filing their tax returns through an appropriate channel and doing that within the given deadline. One method of doing this successfully is by joining hands with finance or payroll management software that is verified and trusted with experience.

Every individual employee can file their tax returns through this payroll management software, which is verified and suggested by the organization. This will ensure uniformity as well as reduce the risk of tax data fraud. You can offer such a service either completely paid or offer it at a discounted rate. The latter will encourage the employees to use the same. Apart from this, you can offer independent software for tax filing at discounted prices to reduce the risk of such incidents.

Another service that is being offered by several organizations is protection against identity theft. This type of service is anticipated to be provided by 63% of the directors by the year 2021. It protects the employees’ data not only in the tax season but also otherwise. It can successfully safeguard employees against any kind of identity theft all around the year.

Conclusion

An organization must safeguard its employees from any data theft at any given point of time. It would be best to educate and inform the individuals working for you about the possibility of such threats to their data. Be aware of any possibilities of such incidents, especially during the tax season. Keeping in mind the points discussed above, we are sure that you will be successful in securing your employees against any tax data fraud.

Post your comment