Dual Tax Regime: Shall I Switch Or Stick To The Old?

Tax calculation from the start has always been a headache for most of the people. With the time approaching to file the annual tax deductions service, most of the people find it weary due to the additional paperwork, forms it includes.

This year, however, there was a wave of change that stunned most of the people. When the budget was announced for the financial year 2020-2024, it came as a surprise for many people. While most of them were expecting that there would be a modification to the existing tax system, the Finance department of the nation changed the game by introducing a new tax regime all together.

In contrast to the old way of calculating tax and deductions, the dual tax regime has many benefits for the sincere taxpayers of the country. With the new tax slab being made public, it also led to a striking debate between both the original and current existing tax calculation process.

In this article below, we will discuss the basics of the dual tax regime and the old tax regime and see the significant difference between the two.

Dual Tax Regime: What Does It Mean?

The dual tax regime is a new way of filing for the income tax from the current year or 2020 onwards. Earlier income tax was collected on the gross annual salary of each person after many deductions. However, with the introduction of the dual tax regime, the overall process of calculating income tax has become easy for the taxpayers.

According to the new tax slab, there will be no deduction on the basic salary, thus allowing people to pay fewer taxes and enjoy their hard-earned incomes. This whole process of calculating taxes will also reduce the overall liability on every single person, as they are not required to pay for anything else other than the pension scheme. Hence the regime is a new advancement that offers promising benefits.

What Led To The Implementation Of Dual Tax Regime?

The dual tax regime is the smart way of calculating taxes without paying for the tax deductions and exemptions.

Each financial year from now onwards gives every taxpayer the additional option to either stick to the new way of tax calculation or opt for the older one as usual. However, if a person is choosing the new tax regime, then there are specific criteria that need to be exercised.

The dual tax regime shall only be chosen by individuals that do not have any other source of business income. If any person has chosen for a dual tax regime, then they cannot apply for deductions and exemptions in their essential income cost.

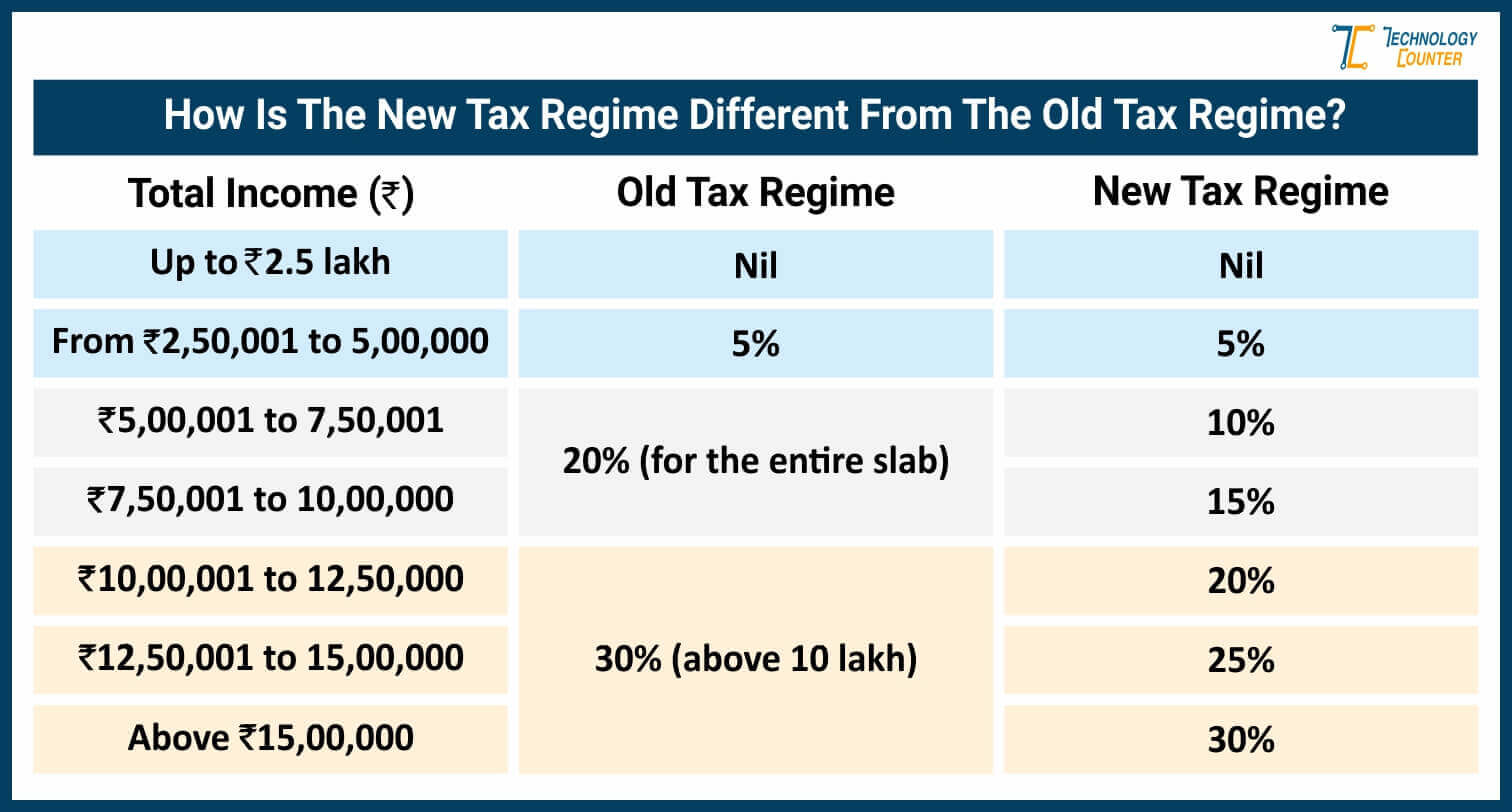

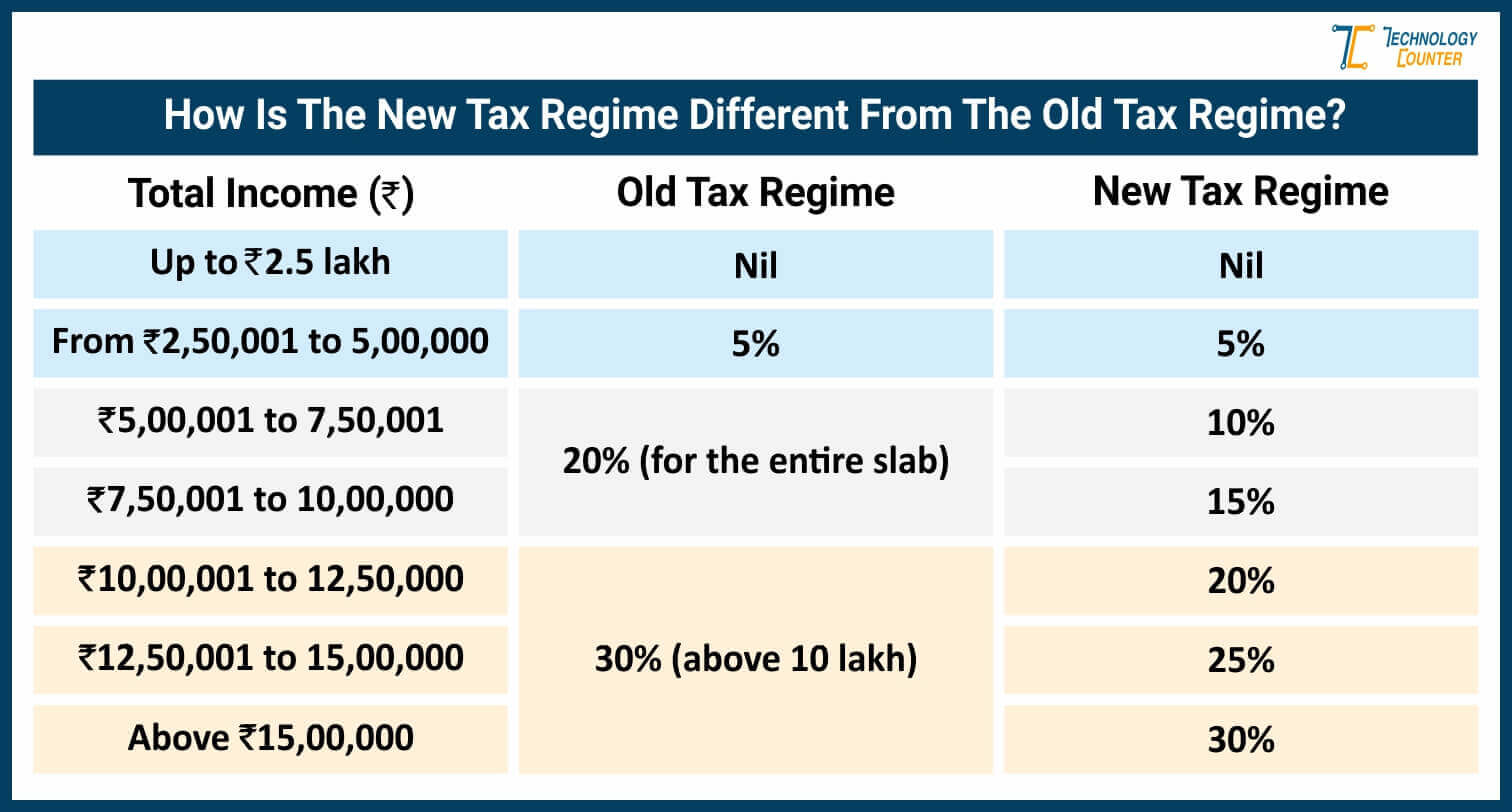

How Is The New Tax Regime Different From The Old Tax Regime?

Our country is known for its democratic policies where every citizen is allowed freedom of choice. From this year onwards the option for paying taxes under the two regimes also rests with the taxpayers. Although the new taxation process has been already introduced, the older tax regime is still in action.

The significant difference between the older and new tax regime is that of cutting the extra exemptions and deductions on the annual income. So, according to the current budget, a person can still vouch for the older tax regime and pay income tax after all the deductions on the necessary annual income, or else go for the newer one and save themselves from additional paperwork and exemptions.

What Does The New Tax Slab Say?

As already mentioned above, the new tax system has already shifted the spotlight to a lower rate of tax collection. There are other benefits also, which are as follows:

- Every individual from now onwards can take back more money to their homes under the new tax scheme.

- Apart from the NPS (National Pension Scheme), no other deductions will be included in the tax system. This makes the tax filing process a lot simpler.

- As the benefits and exemptions are already removed, every person can now have more chances to invest in other things like housing, medical, education, etc.

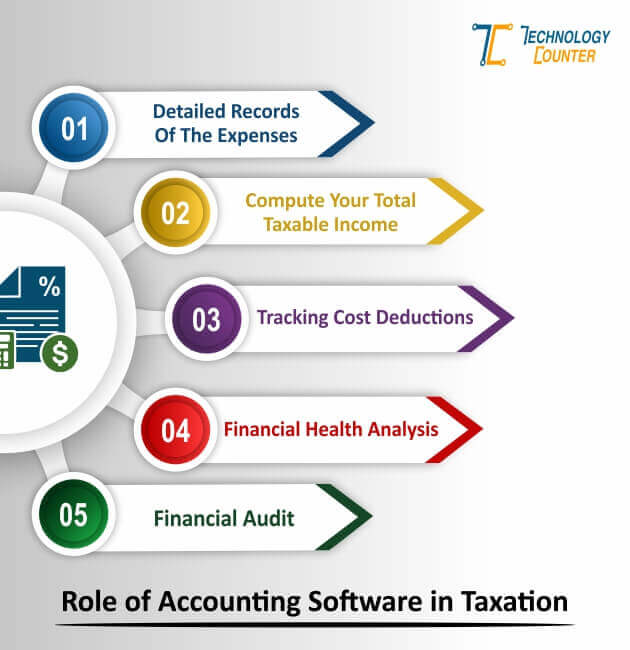

The Role of Accounting Software In Tax Systems

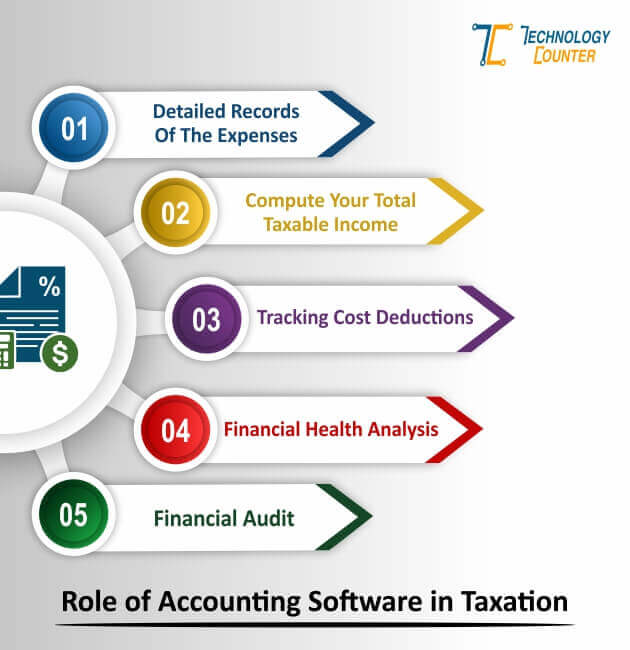

Accounting software plays a key role in any business. It acts as the pivot and helps in turning the whole journey of saving tax from a dreaded nightmare to a happier one.

This software is more reliable than any accountant or tax consultant. The account management software is the best way to work upon the tax-saving bit and additionally helps keep all the finances in check.

There are more reasons why one should readily invest in accounting software when tax deadlines are looming over.

1) One of the foremost things to do before calculating the taxes is keeping detailed records of the expenses. Always make sure to keep all the data organized for quicker analysis of overall gains and losses.

2) Another important thing to do is to keep track of the income information and see if it is up to date. This will help the software to broadly categorize the recent transactions done and segregate it into current income or next year's taxes.

3) The software for account management helps you in tracking deductions that otherwise are deemed unessential by business owners. Some of the least known deductions include office furniture, supplies, rents, travel, the cost for starting the business, and so on. A liable software helps you to manage all these and hence can also guide you in tracking cost deductions.

4) Determining the financial health of any business is a fundamentally paramount job. Therefore, as long as all the reports of your business are up to date, it will help you in sourcing out any information very clearly. Always keep these reports up to date which is mentioned below:

- Profit and loss statements are to be marginalized in a careful manner as they help in calculating the optimum profit on tax forms.

- The expenses report is required to check and foresee all the transactions in detail.

- A balance sheet is used to calculate the assets and liabilities of a company.

- A sales tax summary is also needed when checking on sales tax returns.

5) Audits are a part of any company as the assets and liabilities. The audit process helps in gaining the credibility of the shareholders and also showcases the fairness of the financial statements presented.

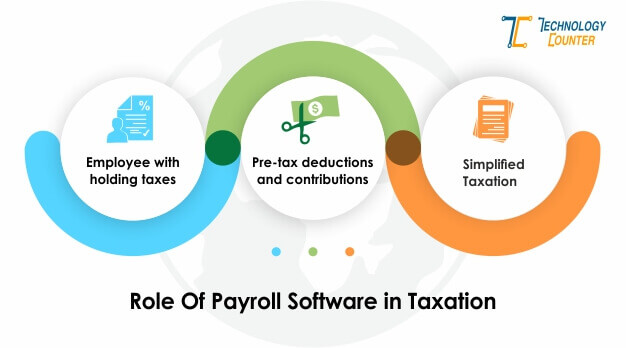

The Role Of Payroll Software in Taxation

The first day of every month or let's say the first week of every month is the day when every employee turns up in the office with happiness. Well, no one should blame them, as this is the time when the salaries go out.

As the complexities surrounding the new tax slab seems not to cease down any sooner, one can think of alternating methods to curb down this tension. A common approach that works well for everyone around the globe is to settle down for reliable account management software.

This software is crafted using the latest technologies and thus helps in giving you a more significant edge over the simplest of tax collections. They also help you get relieved of the additional tension by seemingly making tax calculations more accessible than ever. This helps every individual as well as businesses to save extra time and invest them in some other productive work.

For a small business owner, it is challenging to keep track of the salaries of every individual employee. Therefore, it is highly essential that one should opt for good payroll software. Payroll software is as important for a business as the business accounting software. Here is a list of benefits and long-term goals that can be easily achieved with the help of good payroll software:

- It is true that every small business spends almost more than 5 hours every month, calculating the salary of their employees. This means, on average, every year, companies spend more than 40+ hours calculating the salary only. This is a great loss of productivity and can even result in a slump in profits. Good payroll software can help you save the additional time by calculating the salaries in a jiffy.

- Did you know that for mistakes made in employment taxes there could be a high rate of penalty? Payroll software can help businesses in this sector and also help them score a great deal by avoiding some common errors. Good software for payroll management can even help you save additional taxes by sending you an alert before the aforementioned deadlines.

- When you already have a helping hand that seamlessly streamlines payroll management, then the business can invest the additional time in some other productive work. There will be more time in hand which can be put to use by interacting with local business, customers, and figuring out new ideas.

Comparing the New Tax System with the Old One

Honestly speaking, there is no discreet answer for this, as the main problem lies in the taxation laws abiding in the country. However, if you are looking to acquire a higher discount on the reduction of taxes, then it is recommended to go for the newer slab. To get a clearer picture and before going for the above tax preference here is what every individual taxpayer must do:

- In the first step, it will be a smart move to calculate all the exemptions enjoyed on a personal level. This might include rent, food, and other bills like phone and electricity. After you get a hand on the exemptions, it will be easier to choose the best tax slab according to the needs.

- In the last step, keep a check over the deductions that you claim. Now combine both these above scenarios and then calculate the net taxable income for your annual salary package.

Bonus Tips for Making Tax Filing Easier

- As already discussed before, to stay ahead of the league, you have to do what others only think of. Start off by calculating the deductions and tracking them all throughout the year. Instead of waiting till the 11th month of every fiscal, keeping track of all tax deductions will simply put more money in your wallet and make tax-saving less stressful.

- If you want to be a smart tax player of the country, then always record and track the income and expenses on a daily or monthly basis. One of the easiest ways of carrying out this job is by opting for a business accounting software that easily creates and sends invoices and lessens the burdens on you.

- The third tip to be followed in this journey is to get an in-depth knowledge of all tax forms. It is better to familiarize yourself with the specific forms that you need to fill out early in the day.

- In order to avoid paying hefty penalties at the end of every financial year, it is better to know when the taxes are due. Do not miss any tax payment deadline, which can result in a costly punishment from the IRS.

Conclusion:

Tax implications are something that has been a part of every salaried individual's life since the beginning of the time. And with the dual tax regime, the complexities of calculating taxes are only to shoot up higher than ever. It is true that filing for annual TDS was never any fun, but the introduction of new rules in the system has made people all over the country ponder over the new changes.

So, if you are new to this whole process of taxable income and deductions, then it is better to go with the new tax system, as it is less complicated. But, if you are a veteran taxpayer of the country, then the choice rests with you. Both the new and old tax systems have advantages of their own, and it really depends on the individuals and their opinion to opt for either of the two.

Post your comment