GST or Goods and Services Tax is a value-added tax, This tax came into effect on July 1, 2017, levied at all points in the supply chain with credit allowed for any tax paid on inputs acquired for use in making the supply. We all are aware of the effect of GST on all sectors directly or indirectly. In the present time, whether your business is big or small you will find yourself in constant need of software that can calculate the GST but also calculate accounts, inventories, and finance as well.

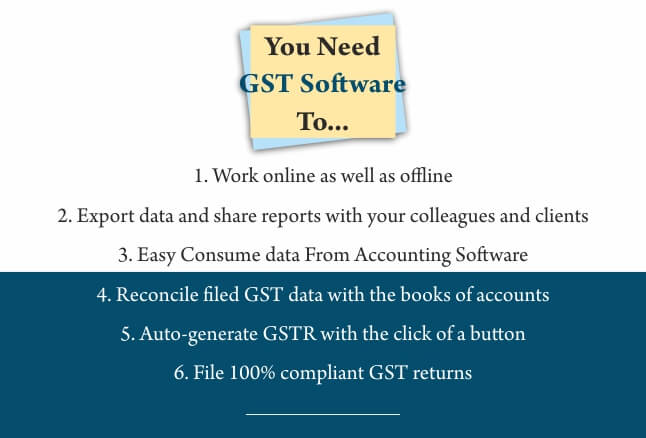

If you are running your business with the same requirements. We suggest you use the GST software which will help you to manage your business and to get an accurate result without any confusion. With various software options at software marketplaces. Finding the Best GST software for your business In India remains easy. Yet, before buying GST software for your business, knowing the major reasons why you need it in the first place could be one of the essentials. In this blog, we will include the top reasons why your business needs a GST solution.

1. Business Process Automation

Business process automation is the call of the time. When the world is dominated by containing cost, better integration, and reducing labor resources. ERP software has already started to automate most of the business processes while making maintaining proper visibility and, transparency. ERP does it all from making entries to the billing stages and a GST-integrated ERP is almost the icing on the cake.

The recent shift from paper money to digital currency after the demonetization, it calls for transparency that perfectly fits with the GST tax reform. GST-integrated ERP boosts the digitalization process with secure database storage and easy online transaction. Also, It will help in simplifying the tax filing process with fewer complications.

In a way to avoid errors, businesses track inventory, sales, purchases, bank, and production entries on a daily basis. GST-integrated ERP with its online transaction and bank reconciliation processing will simplify the digitization process while guaranteeing a fitting database to help approve claims and returns to avoid penalties.

2. Proper Document Management

Under the GST tax system, all your document processes including payments, registration, warning notices, returns, and refunds will completely go digital. In 2024 most of the small businesses are expected to adopt e-filing for GST tax compliance looking forward to avoiding complexities in the coming time.

This reform in your internal system calls for providing your business with the best GST automation software to address challenges & mistakes that may occur while replacing the old indirect tax system with the new one. Thus, adopting a documentation management system for this new tax reform is necessary. GST-integrated ERP solutions would make this job relatively easier and hassle-free for your business.

“Overlooking your payments will take you nowhere, not filing goods and services tax (GST) returns on time could cost businesses their assets, as well as their tax registrations”._TC

3. Compliance Ready

Compliance reform is a major part of the new GST reforms in India. Under the GST reform, the need for compliance reforms is expected to get extensive. Post GST rollout, as new tax laws are in the system, compliance management moved online. Compliances are facing difficulties while managing state-based tax regulations for multi-state transactions.

GST-integrated software will not only help small and medium manufacturers to meet these regulations but also support in maintaining correct financial records while ensuring 100% accuracy and compliance.

4. Systemized Structure

GST software would enable a smooth workflow of services and goods across the country while curbing overall tax payments. For a small or medium-sized business, it would require giving its employees powerful GST-integrated ERP software to enjoy this systemization.

GST is set to bring a new reform especially in our standardized system and with the help of a strong GST-ready ERP system, just businesses need to adopt a GST-ready accounting software system to easily achieve this. GST can change the current goods and service operations to be more well-organized while revamping the indirect taxation process.

5. Flexibility

Software flexibility can mean a lot of things however when it is used to represent a framework of a software system, it normally points to the capability of the solution to adapt to future changes in its necessities. Many small, medium and large companies have already adopted one or another system to automate their business processes. In such a scenario, installing completely new master data in different GST software is a critical issue.

GST software is flexible enough to integrate with the existing system to offer a seamless experience. A GST compliance tool that can ensure flexibility for future changes can help you maintain improved compliance ratings in the long run In such cases, buying GST software will also reduce the business operating cost.

6. Indian Data Security Standards

Data security is the most important and crucial aspect of today’s digital world. The hackers are becoming savvier and more advanced over time. Today no matter how you store your data in the cloud or whether you purchase the most expensive antivirus software, practically smart hackers finally end up stealing your data by pushing the entire system into danger.

Often businesses view digital risk as a threat while using the GSTIN network. The data seems to be at risk if you look at the standards of data security in India. Data crashes, hacking, and cybercrime are all possibilities. Your GST system needs stability and backup options. Thus, buying safe cloud-based GST software is a reliable choice to run your business in the bright light of the new system.

“India ranks on the 23rd position among 165 countries on the Global Cybersecurity Index (GCI)._ITU You can avail of the best deals on Top GST Software in India. With our comprehensive list of software, find your perfect GST Software at our online software marketplace.

.jpg)

.jpg)

__1584509017_122_170_7_192.jpg)

.jpg)

Post your comment