TechnologyCounter provides genuine, unbiased real user reviews to help buyers make informed decisions. We may earn a referral fee when you purchase through our links, at no extra cost to you.

List of 15 Best Accounting Software For Your Business

Showing 1 - 15 of 618 products

Zoho Books

Online Accounting Software for Growing Businesses

Zoho Books is a cloud accounting software that allows you to easily manage the money flowing in and out of your business. It offers features for managing finances, invoicing clients, tracking expenses, generating financial reports, and much more...Read Zoho Books Reviews

TallyPrime is a leading business management solutions in the world, known for its accounting, stock control, reporting and payroll features. With TallyPrime, you don’t need to pay extra for additional features, which makes it affordable for small a...Read TallyPrime Reviews

SAP Accounting is a leading accounting software used by businesses worldwide. With its user-friendly interface capabilities, SAP Accounting streamlines financial processes and provides real-time insights for better decision making. Make managing fina...Read SAP Accounting Reviews

Margs quickest and progressed, GST Ready Accounting Software for SMEs can oversee account payables and receivables effectively. It creates solicitations and reports in 1000s of organizations, Auto-Reconcile bank exchanges with 140 banks and carry onl...Read MARG ERP 9+ Accounting Reviews

Busy Accounting Software is a solution for all your financial management needs. With its user-friendly interface features, Busy streamlines your accounting processes and helps you stay on top of your finances. Say goodbye to tedious tasks and hello t...Read Busy Accounting Software Reviews

FreshBooks account management software simplifies your financial responsibilities and ensures speedy and safe performance. Easily generate invoices, monitor time, and record expenses within minutes. We are dedicated to delivering exceptional customer...Read FreshBooks Reviews

LOGIC ACCOUNT - Complete Retail and Wholesale Software...Read LOGIC Account Reviews

Vyapar is a simple, easy, and all-in-one, business management software for small businesses. Vyapar software is available in online as well as in offline mode for Windows PC and Android mobiles users...Read Vyapar Reviews

Saral is one of the top bookkeeping bundles for India. It extremely effective for upkeep of books of records of an Organization. Information exchange for a free record to download Saral Accounts...Read Saral Accounts Reviews

ProfitBooks is an efficient and speedy business accounting tool designed for small enterprises. It enables you to generate visually appealing invoices, monitor expenses, and handle inventory, even if you lack an accounting background...Read ProfitBooks Reviews

RealBooks is a GST-compliant online accounting software that can readily accommodate enterprises of any size...Read RealBooks Reviews

The Ultimate Online Accounting, Invoicing & Inventory Software Solution Tailored to Your Specific Requirements.

Complete online accounting, invoicing, and inventory management solutions. Manage your finances on the go, Anywhere, Anytime...Read FinalBooks Reviews

Arrive at Accounting Software is an Online Accounting Software situated in India obliging Small and Medium Businesses. We have programming modules for Accounting, POS and CRM. The best part about Reach is all the business tasks are packaged in one pr...Read Reach Reviews

Munim is a Secure & Best Cloud Accounting Software that is developed to help all types of businesses deal with accounting tasks and manage transactions. With this software, you can easily create and manage ledgers, sales invoices, purchase bills, GST...Read Munim Reviews

Book Keeper is Most Simplified Accounting App available on Windows, Android and iOS platforms. You can generate GST invoices and generate GSTR-1,GSTR-2,GSTR-3B and GSTR4 reports. Also, you can access your data across devices by enabling Sync feature...Read iDAKSH Attendent Reviews

- What Is Accounting Software in India?

- Why Your Business Needs Accounting Software?

- Types of Accounting Software in India

- Features of Accounting Software in India

- Benefits of Using Best Account Management Software in India

- Who Uses Accounting Software?

- How to Select the Best Accounting Software for Your Organization?

- 5 Questions to Ask Yourself Before Choosing Accounting Software

- Top 10 Best Accounting Software in India (2025)

- Challenges of Accounting Software

- Future Trends in Accounting Software (2025 & Beyond)

The Buyer’s Guide For Accounting Software

What Is Accounting Software in India?

Accounting software is a digital solution that automates financial management by tracking income, expenses, payroll, tax compliance, and reporting. It helps businesses reduce errors, save time, and stay compliant with Indian financial regulations such as GST (Goods and Services Tax) and TDS (Tax Deducted at Source).

How Does It Work?

-

Automatically records financial transactions

-

Generates invoices, purchase orders, and reports

-

Syncs with bank accounts for real-time reconciliation

-

Calculates GST, VAT, and other taxes to ensure compliance

-

Provides real-time financial insights for decision-making

Did You Know? Businesses that use accounting software save an average of 40% on financial admin costs compared to manual bookkeeping. (Source: Statista)

Why Your Business Needs Accounting Software?

We have discussed the meaning, purpose, and features of financial accounting software. But, the question is why do you need the best accounting software for your organization?

Of course, Accounting Software automates your management tasks and streamlines the day-to-day financial recording and reporting. But, it does a lot more than storing information and drafting financial statements.

The best online accounting software is capable of showing where you can cut expenses and boost productivity. It helps you with decision-making and promotes the steady growth of your business. Here are some important reasons why you need top accounting software.

• Accounting Simplification:

The first and most important function of accounting software is automated calculation. You don’t need to hire a professional account to operate this automated system. Even inexperienced business owners who have little to no knowledge about accounting can run accounting software.

Instead of paying an accountant every month, why don’t you integrate this premium solution into your business and perform all the necessary financial operations on your own?

You don’t need any prior training to operate it. After all, accounting software is designed to automate financial tasks. It does all calculations smoothly.

• Cost-Effective Solution:

Even small business accounting software can handle administrative operations seamlessly. With high-quality and premium accounting software in place, businesses do not need to outsource finance and account management to experts. Not only does it save your labor expenses, but accounting software can save printing costs.

Online accounting software enables businesses to go paperless with every financial record and the entire database stored securely in the system. You may need to pay a monthly fee to the vendor, but that is going to be nothing compared to the hefty accountant fee.

• Financial Transparency:

One of the major advantages of accounting software is that it minimizes the chances of costly human errors. Recurring errors in accounting and bookkeeping can lead to delays and unnecessary losses. Regular errors and failure to report data promptly can result in a business crisis.

That’s when automation comes in handy. It gives you financial transparency and helps avoid errors. Now that every calculation is automated, you can rest assured that your finances and accounts are managed well.

• Gives Easy Access:

Businesses of all sizes need to store financial information. You will need real-time data to promote your business and make strategic decisions. By choosing the best accounting software and having implemented it in your business, you can rest assured that all your financial information and accounting data will be accessible to you. You can generate real-time financial reports and access any information you want.

The business owner can grant software access to the selected employees in the accounting firm. You could provide the employees with their login credentials and allow them to access certain modules of the accounting software. They will be able to operate the online accounting software anytime and anywhere.

Similarly, you can restrict certain members of your firm from accessing the accounting software. You can set up an account for the members and staff you want to use and operate the accounting software. That’s how easy it is for your employees to record the day-to-day financial transactions and create financial statements.

• Forecasting:

It might seem easier to manage finances for accounting professionals' startups. But, as your business grows, you will have to manage a significant volume of data. If you spend all your time managing your finances, how are you going to focus on productivity? Accounting software is the first step to digitizing your business. It collects, analyzes, and stores sensitive data of your company. With advanced small business accounting software, you can focus fully on productivity.

• Productivity:

It might seem easier to manage finances and accounting for a startup. But, as your business grows, you will have to manage a significant volume of data. If you spend all your time managing your finances, how are you going to focus on productivity? Accounting software is the first step to digitizing your business. It collects, analyzes, and stores sensitive data of your company. With advanced small business accounting software, you can focus fully on productivity.

• Tax Compliance:

Best accounting software for small businesses is capable of handling taxes automatically. These systems are designed in a way that they adhere to your state’s tax regulations and perform all the calculations according to the current financial and accounting laws followed in the country. You can select the Best GST Billing Software for one source of audit as well as tax information.

You can store your tax, audit, reports, accounts, and other confidential information effectively. Moreover, you don’t need to study the current financial and tax laws anymore. Even if there is any change in tax compliance, the best accounting software for GST will update automatically.

• Saves Time:

With the accounting software, you will have updated accounting records of inventory, customers, employees, sales, purchases, and other components of your business.

Managing a vast amount of data in a spreadsheet is not only inefficient but also makes it challenging to maintain accurate and comprehensive accounting records. Even if you manage to store this information in a spreadsheet, you are going to have a hard time managing all these accounting records efficiently.

Asset Management Software can help to avoid data management issues. It helps control the frontend as well as backend accounting operations. It saves you plenty of time in recording and managing data. You no longer need to spend your time on manual activities. The system will take care of all the hectic management tasks.

• Better Customer Relationships:

You might argue that accounting software has nothing to do with customer relationships. But, that’s not true! A majority of vendors are focusing on building accounting solutions that offer seamless invoicing and billing functions. They prevent unnecessary delays and simplify communications.

Businesses can personalize the top accounting software according to their requirements and enjoy effective management. Customers like to collaborate with companies that ensure seamless management operations. With effective billing and smoother financial operations, a financial system can improve customer relationships.

• Security:

You cannot afford to lose or hand your financial information to the wrong people. The financial data of a company happens to be the most valuable and sensitive information that needs to be protected from outsiders. Security is one of the main functions of best accounting management software. It keeps your data safe.

Not only does it protect the data from getting jeopardized, but accounting software keeps a copy of all your databases to retrieve the lost information. You get to decide who you want to access your software. Business owners can limit their employees from accessing certain information.

Pro Tip: Choosing GST-compliant accounting software saves hours of manual calculations and reduces tax filing errors!

Types of Accounting Software in India

| Software Type | Best For | Key Features |

| Basic Accounting Software | Freelancers, Startups | Invoicing, Expense Tracking |

| Small Business Accounting | SMEs | Payroll, GST Filing, Bank Reconciliation |

| Enterprise Accounting Software | Large Companies | Multi-location, Multi-currency, ERP Integration |

| Cloud-Based Accounting | Remote & Growing Businesses | Access Anywhere, Automatic Updates |

| Industry-Specific Accounting | Retail, Healthcare, Construction | Custom Modules for Specialized Needs |

| Payroll & Tax Accounting | HR & Finance Teams | Automated Payroll, Compliance, Tax Filing |

Choosing the right type depends on your business size, industry, and financial complexity.

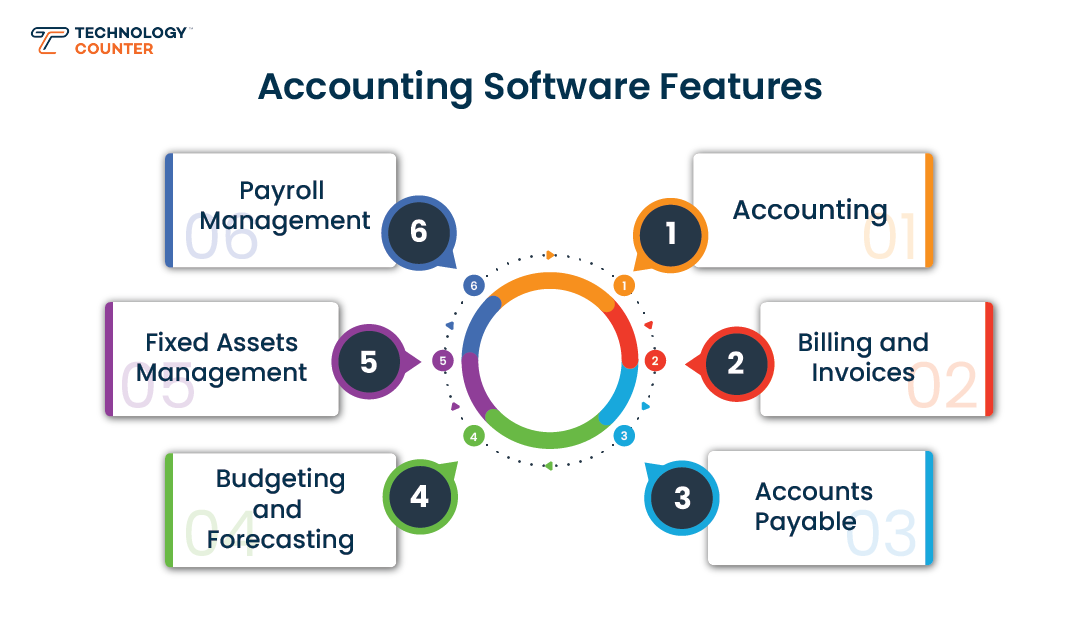

Features of Accounting Software in India

So, what are the best features that Accounting software in India offers? How exactly does it function? Did you get a chance to select the software you would like to integrate into the system? It is quite normal for business owners to think that accounting software offers simplified accounting and finance management.

However, its Features go beyond the basic accounting software. It comes with many add-ons that help you streamline your day-to-day management operations most smoothly.

Some of theaccounting software important features include:

• Accounting

As the name implies, the primary function of the top accounting software is to handle accounts. It helps simplify the work of accountants and bookkeepers. That being said, accounting professionals should be the first feature you must check when investing in this automated finance solution.

The common things that cross our minds when we hear the word accounting are bills payable, bills receivable, fixed assets, journals, ledger, trial balance, profit & loss accounts, and balance sheets. These are the basic accounts that all types of account-keeping software handle. But, the advanced solutions come equipped with various add-ons.

• Billing and Invoices

Some top accounting software in India is specifically designed for billing and invoicing purposes. Their main components include billing and invoice features that help businesses calculate and automate invoices and payments.

However, most vendors consider similar functions as a vital part of a business. That is why they add all the integral financial and accounting features to the Small Business accounting software.

The account receivable software model helps companies optimize their customer invoicing and payment processes. Its purpose is to ensure that customers pay for the goods or services they receive.

The invoice features can be customized according to your payment standards. It can generate automatic invoices and send them to the clients. This feature helps businesses generate 100% accurate invoices and mail them to customers promptly while avoiding common invoicing mistakes. Some accounting software allows employees to clear their invoices right when you send them the electronic invoice via mail.

• Accounts Payable

Just like the receivable feature, the accounting software includes an account payable software that helps businesses keep track of their monthly utility bills, credit repayments, payroll, and payments to the manufacturers and distributors. The accounting software manages both the cash inflow and outflow.

It schedules automatic payments, which means the software supports direct deposit. Now, you can pay directly to your manufacturers, employees, and business associates via bank.

Likewise, the best account payable software can generate purchase orders and allow you to make payments online or through credit cards. It manages your purchases quite well.

• Budgeting and Forecasting

This feature automates the calculation of the financial performance of the business for the previous and current years. It also helps with budgeting. Most used accounting software will help to set an appropriate sales target and plan the best and most feasible budget. Based on your financial performance, you can plan your future financial goals as well.

• Fixed Assets Management

Accounting isn’t just about the income and expenses of your firm. As mentioned before, it is supposed to execute multiple tasks. One such important function includes fixed asset management.

This feature enables business owners to handle a large amount of financial data efficiently. The best accounting software for medium sized businesses manages cost records, depreciation on the plants and machinery, resource allocation, audit history, and so on.

• Payroll Management

One of the most crucial components of the Most used Accounting is payroll management. You owe compensation to your employees. To keep their motivation and offer them an accurate salary or wages every month, you need a dedicated accountant who calculates their salaries based on their performance and attendance. While startups and small-scale companies could manage it without a payroll feature, large-scale and medium-sized companies need an effective payroll management solution to calculate and disburse employees’ salaries.

The good news is that you don’t need to invest in payroll software. The software for Accounting features a payroll feature that calculates employees’ payments and prints their paychecks every month. The payroll solution calculates the payment according to the current compensation regulation in your state. You can even customize the solution based on the payment norms you follow.

This feature deducts the off-days and benefits from the final amount. Overall, you can rest assured that payroll in account management software will calculate 100% accurate compensation for your employees.

The feature deducts tax and other benefits automatically. If your employees want direct deposits, then you can choose bank payments using this feature. No need to print paychecks. Calculate the amount and make payments online. The top accounting software is the safest way to clear your employees' salaries and make the necessary payments.

• Fund Accounting

Best Fund accounting software is also available for non-profit organizations and government agencies. However, they feature different features. Fund accounting software is one such feature that enables businesses to track expenses, donations, GASB laws, financial reports, and grant management.

• Inventory Management

The inventory feature is designed to control stock and track your Inventory Management status. It gives you complete access to your warehouse inventory. Now, you can track the movement of your inventory and the availability of products in the warehouse efficiently. The feature avoids understocking and overstocking issues.

Best accounting software for small businesses can use the automatic ordering system to avoid over and under-order problems. You can track your inventory online and prepare the purchase order straight away. This helps you avoid unnecessary stock in your warehouse. Some advanced inventory management features support multiple warehouses. They track the status of inventory in different warehouses in one system.

• Reports

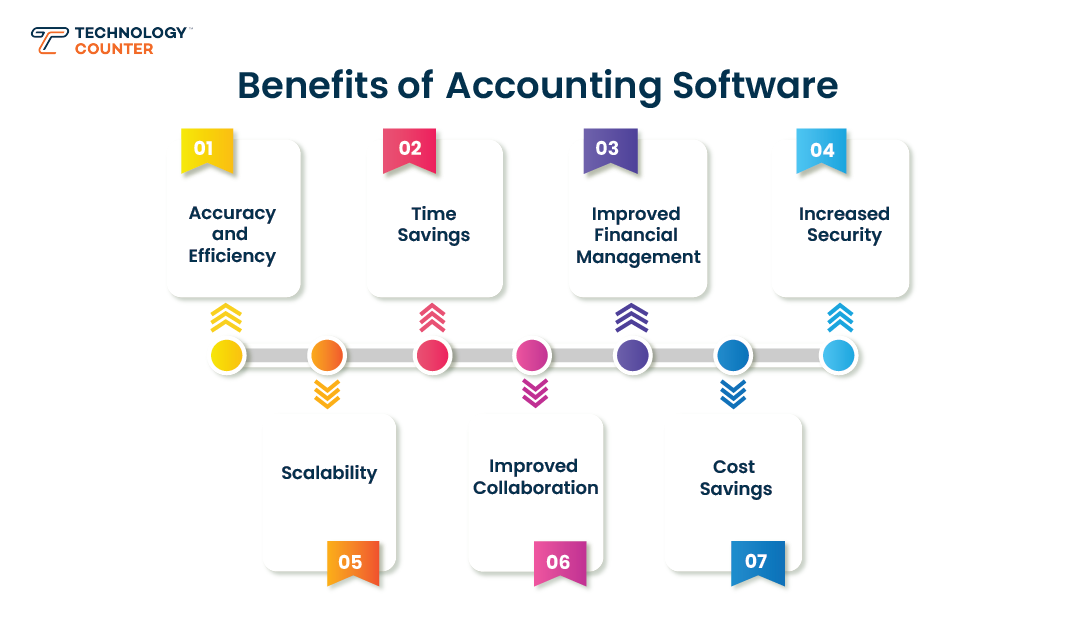

Benefits of Using Best Account Management Software in India

Here is the list of top benefits of account management software in India.

Here is the list of top benefits of account management software in India.

• Accuracy and Efficiency:

Account software in India decreases the need for a manual single entry system and double entry systems and removes the possibility of errors. It automates repetitive procedures and accelerates financial reporting, resulting in more efficient and accurate accounting processes.

• Time Savings:

You can save time by automating repetitive operations like data entry, bank reconciliation, and financial reporting with the best account management software. It frees up your time for more vital responsibilities like analyzing financial data and making strategic decisions.

• Improved Financial Management:

Best Account software in India offers you real-time financial data and insights, allowing you to make informed decisions regarding your company's financial health. It enables you to keep track of your costs, manage your cash flow, and anticipate future revenue and expenses.

• Increased Security:

The accounting system software has additional security features such as data encryption, user access limits, and backup and recovery options. This protects your financial data from cyber-attacks and keeps your company in compliance with regulatory obligations.

• Scalability:

Your accounting requirements will become more complex as your company grows. Top Accounting software is scalable and can meet the needs of businesses of all sizes. This ensures that you can keep using the same software as your company grows without having to move to a new system.

• Improved Collaboration:

The accounting software enables several people to access financial data at the same time, making collaboration more convenient and efficient. This helps to streamline financial procedures and enhances team collaboration.

• Cost Savings:

Accounting software in India can assist in lowering accounting-related costs. You can save money on labor and resources by automating tasks and decreasing errors, as well as lowering the risk of financial losses due to errors.

Who Uses Accounting Software?

Accounting software is used by a wide range of individuals and organizations to manage their financial operations efficiently. Here’s a look at who benefits from using accounting software:

1. Small Business Owners

Small business owners use accounting software to handle their day-to-day financial tasks, such as invoicing, expense tracking, and financial reporting. This software helps them save time and ensure their finances are accurate and up-to-date.

2. Freelancers and Solopreneurs

Freelancers and solopreneurs rely on accounting software to manage their income and expenses, track billable hours, and create invoices. These tools help them stay organized and maintain a clear picture of their financial health.

3. Medium and Large Enterprises

Medium and large enterprises use advanced accounting software to manage financial operations, such as payroll processing, inventory management, and compliance reporting. This software integrates with other business systems, providing a comprehensive financial management solution.

4. Accountants and Bookkeepers

Professional accountants and bookkeepers use accounting software to streamline their work, ensuring accuracy and efficiency in managing their clients' financial records. This software provides powerful tools for financial analysis, tax preparation, and auditing.

5. Nonprofit Organizations

Nonprofit organizations use accounting software to manage their finances, track donations and grants, and ensure compliance with regulations. This software assists NGOs in ensuring financial openness and accountability.

6. Project Managers

Project managers use accounting software to track project costs, budgets, and profitability. These tools help them manage the financial aspects of projects, ensuring they stay within budget and achieve financial goals.

7. Retailers

Retailers use accounting software to manage sales, inventory, and expenses. These tools help them keep track of their financial transactions, analyze sales trends, and make informed business decisions.

8. Manufacturers

Manufacturers rely on accounting software to manage production costs, inventory, and financial reporting. This software helps them optimize their operations, reduce costs, and improve profitability.

9. Consultants

Consultants use accounting software to manage their billing, expenses, and financial reporting. These tools help them track their income, client management invoicing, and maintain accurate financial records.

10. Healthcare Providers

Healthcare providers, such as clinics and hospitals, use accounting software to manage patient billing, insurance claims, and financial reporting. These tools help them streamline their financial operations and ensure compliance with healthcare regulations.

Accounting software are essential tool for anyone involved in managing finances, from small business owners to large enterprises, and from professional accountants to nonprofit organizations. They provide the necessary tools to handle financial tasks efficiently and accurately, helping users maintain a clear and organized view of their financial health.

How to Select the Best Accounting Software for Your Organization?

Accounting software is a long-term, powerful, and expensive investment for any organization. Hence business leaders need to select the best accounting software for their business that will align with your needs and budget.

TechnologyCounter as a software recommendation platform understands the challenges that business owners go through while searching for the right tech solutions for their organization. Our software experts have made a comprehensive guide that will help you select the best accounting management software.

1. Evaluate your requirements:

The first step to selecting the best accounting software for your business is to understand your business requirements. Every business will have a different process to execute the accounting operations and goals to achieve.

The challenges of the accounting department to achieve their goals will also differ from organizations. Business leaders can evaluate the business challenges that cause hindrances in achieving organizational goals.

The best to understand the business accounting challenges is by speaking to the HR, payroll, and account teams. Understanding your requirements will help you to choose the right features in the accounting software to overcome all the common invoicing mistakes.

Furthermore, the budget plays the most vital role in selecting the accounting software for your business. Business leaders need to allocate the budgets and ensure that they find the best solution that offers all the required features in the budget.

Additionally, when speaking to the accounting software vendor you need to ensure that they do not have any hidden or additional charges after the implementation. Moreover, they need to ensure that all products, features, and services will be available in the accounting system at the quoted price.

2. Explore all the available options:

Now that you know your requirements, challenges, and budget for the best accounting software for your business. You can start exploring all the available SaaS vendors that provide accounting software for various organizations.

TechnologyCounter is a software recommendation platform with an extensive list of all the top accounting management software. You need to do an in-depth evaluation of the vendor based on the user reviews, pricing, and features.

Once you explore all software vendors, their features, and prices you can filter the best accounting software that adapts to your business goals and budget with ease.

3. Evaluate the scalability and reliability of the solution:

The next step after filtering the vendors that fit your budget and needs you will have to evaluate and compare the selected vendors. Business leaders need to ensure that the accounting software that they select should be scalable and reliable.

The best cloud based accounting software will be a scalable and reliable solution for business owners. Because a scalable solution will grow with your business and a reliable solution will ensure that the system is up and running always.

4. Evaluate the customization and integration capabilities:

Business leaders need to also consider the customization and integration capabilities of the vendor while selecting the right accounting management software. Because every business will have a different requirement and work process to achieve its business goals.

Hence, when your business is evaluating the accounting system software you need to explore customization opportunities. The top accounting software will allow you to customize the tool as per your business requirements.

Business leaders might use a different system for various processes or departments to streamline their operations. Now imagine if your team has to manually gather data from all the systems and accumulate it on a central server.

It will just increase the number of duplicate entries and make it difficult for the team to understand the mistakes and arrears. Hence, business leaders need to ensure that the accounting vendor seamlessly integrates third-party applications on a single platform.

As a result, your accounts team can have an overview of the entire organization's accounts and process them through a single window.

5. Check the user interface and customer support:

The user interface plays a crucial role in selecting cloud based accounting software. The core purpose of implementing accounting software in your work process is to streamline financial management and fix the financial issues of the business.

The software with a difficult user interface will increase the challenges of the accountants and bookkeepers instead of reducing them. Thus, it is crucial to select the best accounting software in your business that is user-friendly and that will help the team to navigate with ease.

The accounting software will give you a free demo and free trial where you can evaluate the user interface of the system. After-sales support is another crucial aspect that business leaders need to consider while selecting the right accounting software for their business.

If this software has downtime, crashes, or lags; it will hamper the productivity of your accountants and bookkeepers. Therefore, it is essential to select the best accounting management software that has reliable, friendly, and efficient customer service that resolves your queries and grievances quickly.

6. Get expert opinion or explore the industry niche:

The business leaders can explore more vendors that the other competitors use in their process. Implementing an industry niche accounting software will ensure that your business gets the competitive edge that it requires.

Because businesses in the same industry will have similar goals and challenges, they face so the accounting system will have all the features that you require

We understand that it can be a draining task to find the right accounting tools for your business. We have a team of passionate, friendly, and knowledgeable software experts that will help you to select the right accounting software as per your budget and needs which will help you to cut down the cost.

Furthermore, you can also find authentic user reviews from the vendors that have used that particular software.

7. Think about the future:

Business requirements are constantly evolving and so will your business goals. Moreover, every entrepreneur has a vision for their business before even starting the project.

It should happen that your business will grow and the accounting management software will become outdated by then that doesn’t support your organization’s needs anymore.

Therefore, business leaders need to understand their future business expansion plans and select the top accounting tools accordingly

If you follow above mention steps and consider the aspects mentioned, you will choose the right accounting software as per your needs and budget

Pro Tip- Choosing accounting software is a long-term investment—make sure it aligns with your future growth plans!

5 Questions to Ask Yourself Before Choosing Accounting Software

Selecting the right accounting software is crucial for effectively managing your business's finances.

Here are the top five essential questions to consider before making your decision:

1. What Are Your Business Needs?

Ask Yourself: What specific accounting tasks does my business need help with (e.g., invoicing, payroll, expense tracking)?

Why It Matters: Identifying your needs helps narrow down software options that offer the necessary features to support your business operations effectively.

2. What Is Your Budget?

Ask Yourself: How much am I willing to spend on accounting software?

Why It Matters: Understanding your budget constraints ensures you select software that is both affordable and meets your financial management requirements without overspending.

3. Is the Software Scalable?

Ask Yourself: Can this software grow with my business?

Why It Matters: Choosing scalable software ensures that it can accommodate your business's growth and evolving needs, avoiding the hassle of switching systems as your business expands.

4. How User-Friendly Is the Software?

Ask Yourself: Is the software easy to use and understand?

Why It Matters: A user-friendly interface minimizes the learning curve, reducing the time and effort required to train staff and lowering the risk of errors in financial data entry and management.

5. What Are the Integration Capabilities?

Ask Yourself: Does the software integrate with other tools and systems I use (e.g., CRM, payroll services)?

Why It Matters: Integration capabilities streamline your workflow, enabling seamless data transfer and reducing manual entry, which enhances efficiency and accuracy.

Considering these top five questions, you can make a well-informed decision and choose accounting software that aligns with your business needs, enhances your financial management processes, and supports your business growth.

If you answered ‘Yes’ to most of these, it’s time to invest in an accounting solution!

Top 10 Best Accounting Software in India (2025)

We have analyzed 50+ accounting software based on features, pricing, scalability, and user satisfaction. Here are the top picks:

| Software | Best For | Key Features | Free Trial? |

| Zoho Books | Small & Medium Businesses | GST, Expense Management | Yes |

| TallyPrime | SMEs & Enterprises | Invoicing, Payroll, Tax Compliance | Yes |

| Busy Accounting | GST Filing & Inventory | Multi-currency, Stock Management | Yes |

| QuickBooks | Cloud-Based Businesses | Bank Sync, Automated Reports | Yes |

| Marg ERP 9+ | Retail & Manufacturing | POS, Inventory, GST | Yes |

| Vyapar | Small Business & Startups | Simple Interface, Invoicing | Yes |

| Focus I | Enterprises | ERP Integration, Business Intelligence | No |

| ProfitBooks | Startups & Freelancers | Inventory, GST | Yes |

| Sage 300cloud | Large Businesses | Multi-Company, Financial Reports | Yes |

| ZipBooks | Cloud Accounting | AI-Based Insights, Automation | Yes |

Challenges of Accounting Software

While accounting software offers numerous benefits, it also comes with its own set of challenges. Understanding these challenges can help businesses make informed decisions and mitigate potential issues.

Here are some common challenges of using accounting software:

1. Cost

High-quality accounting software can be expensive, especially for small businesses and startups. The costs of obtaining, implementing, and maintaining software can be enormous.

2. Complexity

Some accounting software can be complex and difficult to navigate, especially for users without an accounting background. This complexity can lead to errors and inefficiencies if users are not adequately trained.

3. Data Security

Storing sensitive financial information in accounting software raises security concerns. Businesses need to ensure that their software has robust security measures in place to protect against data breaches and cyberattacks.

4. Integration Issues

Integrating accounting software with other business systems, such as CRM or ERP, can be challenging. Compatibility issues can lead to data silos and inefficiencies, requiring additional time and resources to resolve.

5. Customization Limitations

Some accounting software may not offer the level of customization needed to meet specific business requirements. This can result in businesses having to adapt their processes to fit the software, which may not always be ideal.

6. Dependence on Technology

Reliance on accounting software means that any technical issues, such as software bugs or system downtime, can disrupt business operations. Businesses must have contingency plans in place to address such incidents.

7. Regular Updates and Maintenance

Keeping accounting software up to date with the latest features and security patches requires regular maintenance. This can be time-consuming and may require additional resources, especially for businesses without dedicated IT staff.

8. User Training

To maximize the benefits of accounting software, users need to be adequately trained. Training can be costly and time-consuming, and without it, users may not fully utilize the software’s capabilities.

9. Data Migration

Transitioning from one accounting system to another can be a complex process. Data migration involves transferring historical financial data, which can be prone to errors if not done correctly.

10. Scalability Issues

As organizations expand, their accounting requirements get more complex. Some accounting software may not scale well with the business, requiring costly upgrades or a complete switch to a more robust system.

11. Compliance and Regulatory Changes

Accounting software must be kept up to date with the latest compliance and regulatory requirements. Maintaining compliance can be difficult, especially in businesses with constantly changing requirements.

12. Customization and Flexibility

Businesses often need specific features that standard accounting software may not provide. Finding a solution that offers the right level of customization and flexibility can be challenging.

Understanding these challenges can help businesses choose the right accounting software and implement strategies to overcome potential issues. By addressing these challenges proactively, businesses can ensure they maximize the benefits of their accounting software while minimizing disruptions and inefficiencies.

Future Trends in Accounting Software (2025 & Beyond)

Just like any other industry, we will witness several trends in accounting software in 2025. Automated Accounting software has become quite mainstream. Nowadays, software developers are trying to integrate artificial intelligence and machine learning into accounting management systems. The advancement in Accounting systems by technology has made significant changes. The main goal is no longer limited to basic accounting and mundane financial management tasks.

It is rather about the overall financial growth of the company. The main purpose of accounting software is to automate as many hectic manual tasks as possible. Now that a majority of manual activities are automated, accountants and managers can focus on improving the firm’s productivity. They can focus on marketing functions and other such productive and important activities.

• Industry-specific Software:

Earlier, businesses had to implement standard and common accounting software that worked according to the one-size-fits-all approach. These solutions were not customization, neither were they capable of offering seamless integration with third-party apps. Account-keeping software has changed a lot in recent times. Vendors are more concerned about the quality of the solution. They put industrial requirements before everything.

The current market trend in the accounting development industry is the company-specific and latest accounting systems, which means an automated accounting and financial system that caters to specific industrial requirements. As mentioned above in the post, accounting software can be customized. You get to decide the features and modules you want in the system.

Depending on your business structure and the basic practices you follow, you can select your industry-specific modules and pay accordingly. Make sure that outdated and traditional software will not help you progress or boost your productivity.

It will only perform mundane accounting functions because this is what this standard software is designed for. Sooner or later, you are going to have to replace the system with the most popular accounting software.

So, why not choose a wise option in the beginning and save some bucks on a replacement? It is extremely important to consider the current market trends and select an industry-specific solution that fits your business structure.

• Machine Learning:

The rise in machine learning and AI-powered financial and accounting management has surprised quite a lot of businesses. According to surveys and reports, the growth in AI-powered accounting is never going to end anytime soon. More and more people like the idea of leaving hectic tasks to machines while allowing humans to focus on more productive activities.

One of the major functionalities of accounting and management software is the automation of tasks. Machine learning makes the overall computation a whole lot faster and easier for accountants. Now, they will not have to waste their time calculating employees’ salaries or deducting taxes. It supports effective and faster calculations, easy fraud detection, minimized errors, and high productivity.

• Automation:

According to the research, software developers are trying to improve accounting systems for small businesses in terms of automation. They are now more focused on introducing changes that could automate the entire workflow management.

Their major goal is to automate as many mundane activities as possible so that a heavy workload burden is lifted off the accountant's shoulder. In simple terms, workflow automation is increasing with each passing day. Sooner or later, there will be no financial operation or accounting that needs to be performed manually.

• Cloud based Accounting Software:

Gone are the days when companies would implement those complicated, on-premises solutions that took months to deploy. Still, many companies rely on on-premises solutions to record their sensitive financial data and generate reports.

However, software developers have started focusing more on cloud accounting software. More and more companies will embrace this new market trend and install an automated system. With the help of automation, cloud-based computing, AI, machine learning, and Blockchain technology, not only is the process of maintaining ledgers simplified, but also the development of results.

Therefore, it won't be wrong to say that technology is responsible for an evolution in the accounting industry.

According to Gartner, AI-driven accounting software is expected to reduce manual bookkeeping time by 50% by 2026.

Find Out How Accounting Software Can Help Your Business

Seeking more information about accounting software? Explore these essential resources to gain valuable insights and make informed decisions:

- Accounting Mistakes Your Small Business Should Avoid

- ERP vs Traditional Accounting: Which One Is Better?

- Financial Issues SMBs Often Face and How to Fix Them

- 5 Accounting Mistakes That Affect Small Businesses

- How Technology Has Changed The Accounting Industry

Still unsure? Get a FREE consultation from our software experts at TechnologyCounter to find the perfect accounting solution for your business!

.png)

.png)

.png)