TechnologyCounter provides genuine, unbiased real user reviews to help buyers make informed decisions. We may earn a referral fee when you purchase through our links, at no extra cost to you.

List of Top 15 Payroll Software for Your Business

Showing 1 - 15 of 446 products

Zoho Payroll

Payroll crafted for building a better workplace

Zoho Payroll is a cloud-based software that allows businesses to effectively manage their payroll needs. It includes features for employee onboarding, payroll processing, and an employee self-service portal. Additionally, it ensures compliance with...Read Zoho Payroll Reviews

greytHR is an integrated cloud-based HR and payroll software with 100% statutory compliance. It reduces and simplifies transnational HR tasks while delivering reliable and quick results. It also automates all the HR transactions by a single login das...Read greytHR Reviews

Tankhwa Patra is a leading HRMS and Payroll Software which acts as your digital HR Super Hero which makes the work of HR easy...Read Tankhwa Patra Reviews

Gusto is a all-in-one platform designed to simplify and streamline your businesss payroll, benefits, and HR processes. With Gusto, you can say goodbye to manual paperwork and hello to effortless management. Its time to unleash the full potential of y...Read Gusto Reviews

Trusted by 2500+ customers, Zimyo is a unified HR and payroll software that helps automate tedious HR processes, eliminate payroll errors, and foster positive employee experiences. It offers a comprehensive suite of 50+ modules, including a Core HR,...Read Zimyo Reviews

All-In-One HR Platform.36 apps covering all your requirements across core HR, talent management, payroll and business expenses...Read Qandle Reviews

Beehive is one of the fast emerging leaders in providing the companies with the Cloud-based and or an On-premise HRMS software that lists out a number of highly effective features to run HR functions efficiently...Read Beehive HRMS Reviews

factoHR is a Cloud-based HR & payroll software for SMEs. Automates payroll, attendance, leave, and compliance. Saves time, reduces errors, and provides mobile access to employees via its Employee Self Service (ESS)...Read factoHR Reviews

HROne is the product of Uneecops Workplace Solutions Private Limited which is a subsidiary of Uneecops Group. a 450 Cr. Conglomerate established in 1996...Read HROne Reviews

Pocket HRMS can revolutionize your HR and Payroll operations by completely digitalizing your Payroll processing, attendance, digital onboarding, and HR operations, allowing your employees to access their information anywhere anytime using the latest...Read Pocket HRMS Reviews

Crystal HR started its Journey over 25 years back in 1993 when the market especially the SMB segment was still looking for a smart solution to efficiently run their payroll at an affordable cost...Read Wallet HR Reviews

sumHR is Indias fastest growing Human Resources Management (HRMS) Software assisting organizations to manage their entire HR lifecycle activities on a single platform...Read sumHR Reviews

Complete Payroll solution right from attendance punch to generation of Payslip.

Saral PayPack by Relyon Softech Ltd is a trusted payroll processing software that simplifies payroll management with features like attendance tracking, statutory compliance, and tax management...Read Saral PayPack Reviews

Keka is a Modern HR and Payroll software for small and medium sized businesses that manage employee engagement, it has time tracking, attendance management, and leave management system...Read Keka HR Reviews

Crystal HR started its Journey over 25 years back in 1993 when the market especially the SMB segment was still looking for a smart solution to efficiently run their payroll at an affordable cost...Read Wallet HR Reviews

- What Is Payroll Software?

- Key Features to Look for in Payroll Software

- Best Payroll Software in India (2025) – Feature Comparison

- Benefits of Using an Payroll Software in India

- Who Uses a Cloud Based Payroll Software?

- Why Do You Need a Payroll Software in India for Your Business?

- Types of Payroll Software for Different Businesses

- Payroll Software Technology Trends

- How to Choose a Payroll Software for Your Organization?

- Final Thoughts & Recommendations

The Buyer’s Guide For Payroll Software

TL;DR – Quick Summary

✅ Top Payroll Software: Keka, Zoho Payroll, greytHR, Zimyo, Saral PayPack, Qandle, and more.

✅ Key Features to Look For: Direct deposit, tax filing automation, compliance management, ESS, integrations, and reporting.

✅ How to Choose? Consider business size, compliance needs, integrations, and cost.

✅ Pricing: Starts at ₹1,500/month for SMEs; ₹10,000+ for enterprises.

Let’s dive into how payroll software works, its key benefits, and a detailed comparison of the best options available.

What Is Payroll Software?

Payroll software is a tool for managing employee salaries and benefits. It automates tax calculations, wage deductions, and generating payslips, saving businesses time and reducing the risk of human error. By streamlining the payroll process, businesses can ensure accurate and timely payment of salaries, boost employee morale, and increase productivity.

In addition to simplifying payroll tasks, payroll software can also provide valuable insights into payroll expenses. It allows businesses to generate comprehensive reports and analytics, enabling them to monitor payroll expenses and make informed decisions about resource allocation. This emphasis on managing your business efficiently through payroll software underscores its critical role in overall business administration and financial management.

Moreover, payroll software ensures compliance with tax regulations, reducing the risk of costly penalties and audits.

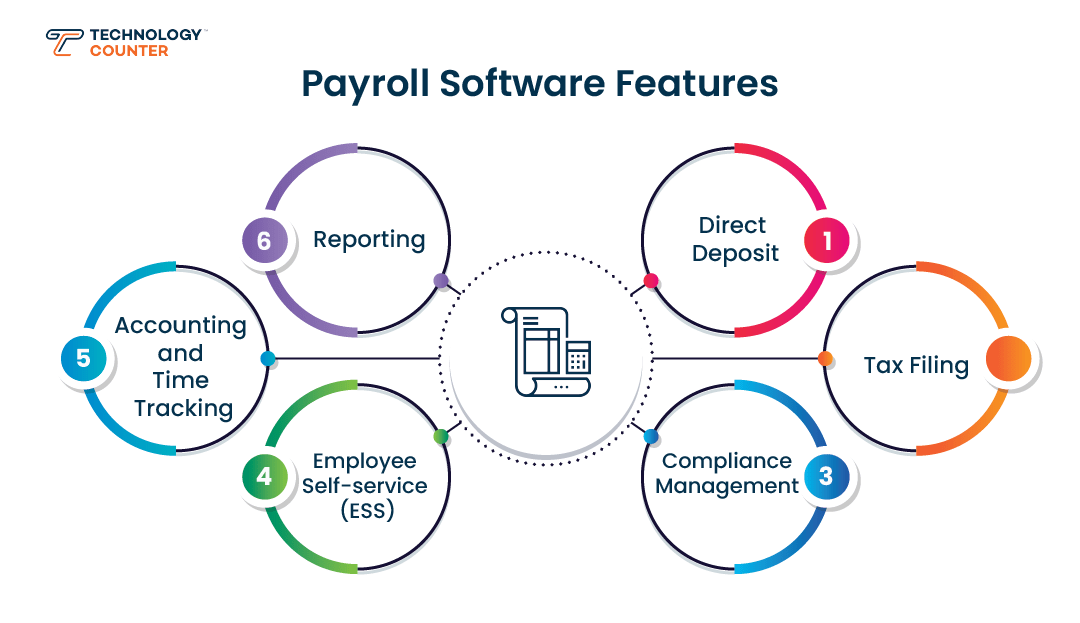

Key Features to Look for in Payroll Software

The payroll software offers tons of services. Gone are the days when businesses would hire a qualified and trained payroll service provider to issue paychecks to the employees.

Do you know this is often the first and most important technology that startups and new companies purchase? They understand how this cloud based payroll software can save time and streamline business management. When you are searching for payroll software, you need to ensure that the solution you are buying and integrating into your firm can offer you the best features.

As mentioned above, this software can perform an extensive range of tasks as long as you purchase the best one. Whether you have just started your business or running a multinational company, you must buy the payroll software that fits your business requirements and budget.

Business owners must pay special attention to the functionalities of the software they purchase. Here, we have mentioned some important yet common capabilities of quality and reliable payroll software. Let’s have a look:

• Direct Deposit:

A direct deposit is a common method to pay your workers. In direct deposit, the payment is initiated from the employer's bank account and is transferred to the worker's bank.

There is a reason why direct deposit is considered the most sought-after method for payment disbursement. First, it is a faster and safer way to transfer payments than payments through mail. The most important reason is that direct deposit saves the details of every transaction in your digital records.

The time when employers would hand out the paycheck to each employee on the weekend is long gone. Direct deposit is one of the important features of payroll software. It saves you the printing cost of checks. It is a win-win for employees and firms. Your employees get their payments on time and you don’t have to record each transaction manually. The details are recorded digitally.

• Tax Filing:

Another important functionality of payroll software is tax filing. It enables you to automate the calculation of state, federal, and local taxes your business is supposed to clear.

Like any manual calculation, filing your taxes and calculating the exact amount you owe to the government can turn out to be a hectic task. Moreover, there is a chance you will end up making errors in the calculation. To prevent such issues and miscalculations, businesses should leave this challenging task to the best payroll software.

The online payroll software is not only capable of calculating your taxes, but it sends these documents to the right agency. Research suggests one in every 3 small firms spends over 40 hours every year calculating and filing their federal taxes. If you calculate taxes on your own and make errors, there is a high chance you will face a delay in the return.

• Compliance Management:

The employment regulations are getting tougher every year. If the government passes a new overtime rule in the coming years, then it will make payroll even more challenging for businesses.

So, instead of worrying about these new laws and the current regulations, why don't you let the payroll software manage the process for you? There is no denying that businesses face a lot of difficulties in keeping their employee's payroll process in line with the current state or federal laws. First, you will have to understand employment laws. The second step is to adjust your current payroll procedure according to these new federal laws.

Compliance management is an important feature of open-source small business payroll software. Given that the software you have purchased offers compliance management features, rest assured the system will automatically be upgraded if the government passes any new employment law.

• Employee Self-service (ESS):

Is it possible for you to check all your employees’ remuneration accounts manually if an employee of your firm enquires about their salary? Chances are you don’t even have time to access your payroll management system to gather information about your worker’s salary, let alone look into the accounts book.

ESS or Employee self service feature in the payroll processing softwarecan take one of the biggest burdens off your shoulders. The software enables employers to provide their employees with access to the software. You get to provide them with unique login details. Every time they need to search for information or make updates, they can do it themselves.

You can select the employees you would like to access the system. They only need to submit their login credentials to get access to the software. Before you make a purchase, make sure the payroll processing software you are buying offers the ESS functionality. It must be customizable. Ask if the user's permission can be customized. After all, you may not want each employee of your firm to access the software.

Though almost all types of payroll-related software have employee self-service features, it is best to check it and discuss this functionality with the vendor before making a purchase. Another important thing to consider is mobile compatible software.

Not every employee has a laptop. Even if they have access to the desktop, it is going to be uncomfortable for them to bring their laptops to work unless it is part of their job. So, make sure that the software works well on smartphones.

Whether the vendor offers a mobile-compatible website or a standalone mobile application, it must feature an intuitive design and a user-friendly interface. The last thing you want is for your employees to keep asking you to open the software.

• Accounting and Time Tracking:

When you initiate a payment from your bank account for business expenses, you have to make an entry for the transaction in a separate ledger. Your accountant is supposed to record these entries in the accounting books so that they can prepare the financial statement for your firm.

But, imagine if you could record all these transactions automatically. Well, that is possible with the payroll process system. Another great feature of this cloud based payroll software is its ability to link the accounting software to small business payroll software.

Every time, you make payment through this software or make any monetary updates in the solution, the same will automatically be recorded in your accounting software. Similarly, you can link your payroll software to time-tracking software.

When your employee updates their working hours for the month or the number of days they were present in the time-tracking software, the data will be recorded in the software as well. This will help you with the final wage or salary calculation according to the employee’s performance and the total working hours.

Though payroll, accounting, and time tracking are two different functionalities of payroll management, they both save you plenty of time in entering duplicate entries. In addition to saving you time and effort, the integration of these solutions into your payroll can reduce the chances of manual data entry errors.

Make sure to ask your vendors if the payroll software can be integrated with third-party apps and software. How can you integrate these solutions? If you already have the time tracking and accounting systems installed, ask your vendor if they can help you integrate these systems with the payroll processing software.

• Reporting:

Most types of business software feature a reporting module that provides the users with a comprehensive report of their business management. The best payroll software offers a business report that gives you a quick insight into the payroll process throughout the year. It is an important tool to learn about your payroll management system as well as the latest trends.

The software provides you with a clear view of your budget, payroll info, and taxes. This information can help businesses to improve their payroll accounting operations. Moreover, you can use this information to improve your payroll process and ensure cost-effective business operations.

Best Payroll Software in India (2025) – Feature Comparison

| Software | Best For | Key Features | Pricing (₹/month) | User Rating(TechnologyCounter) |

| Keka | Mid & Large Enterprises | Payroll, HRMS, Attendance | ₹4,999+ | 4.2/5 |

| Zoho Payroll | Startups & SMEs | Payroll, Tax Filing, ESS | ₹1,500+ | 4.5/5 |

| greytHR | HR & Payroll Automation | Compliance, Reports, ESS | ₹3,500+ | 4.3/5 |

| Zimyo | Growing Businesses | Payroll, Loans, Benefits | ₹2,999+ | 4.5/5 |

| Saral PayPack | Compliance-Focused Firms | Payroll, PF, ESI, TDS | ₹3,000+ | 4.5/5 |

| Qandle | AI-Driven HR | Payroll, AI Chatbot, Compliance | ₹4,999+ | 4.7/5 |

Note: Prices are approximate and may vary based on features and employee count.

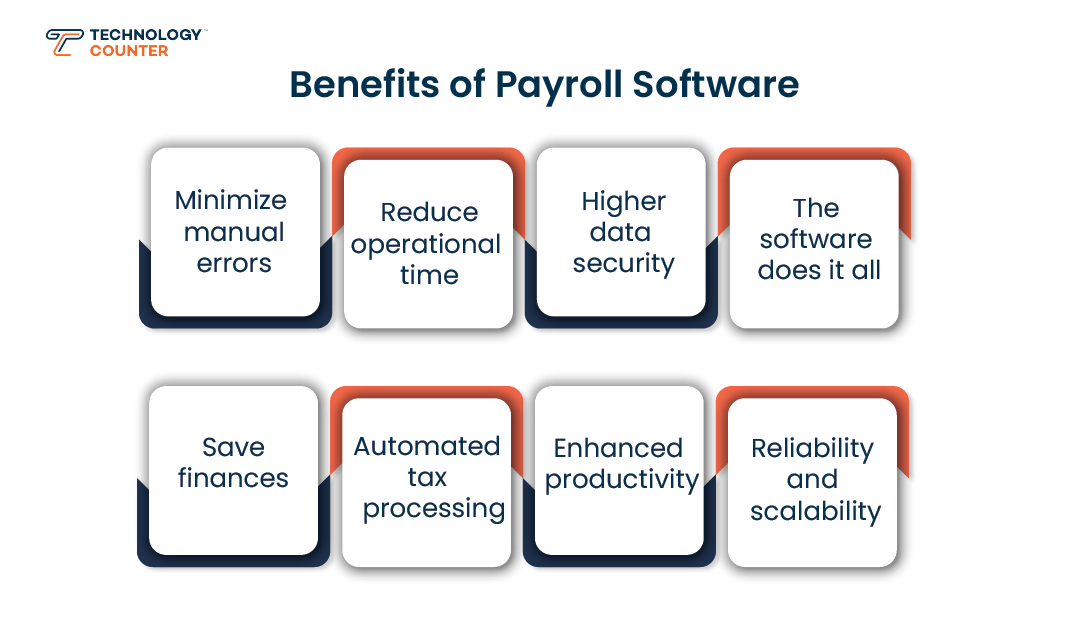

Benefits of Using an Payroll Software in India

There are many benefits of implementing the best payroll software in India to enhance many aspects of your business.

We have compiled a list of the top benefits of Payroll software in India:

• Minimize manual errors:

Payroll is the most essential part of any organization because payday is what employee works for. If your payroll has multiple arrears and errors, it will create dissatisfaction in the employees and you might have legal charges for that.

The top payroll software in India will process the entire payroll automatically without any manual interaction. Hence, there are zero chances of manual errors to ensure the employees get paid for what they deserve based on their input.

• Reduce operational time:

As discussed earlier, the best payroll management software in India will automate most of the payroll operations. The HR team can focus on core HR functions like employee development, work process enhancement, and other crucial aspects. The top payroll software will help the management to execute the operations with a few clicks from anywhere at any time.

• Higher data security:

The payroll data is a piece of confidential information of the employee. Hence, it is essential to keep data private and secure your information from external threats. The best cloud based payroll software will give unique credentials for every employee to get information that they have access granted to. Additionally, the SaaS payroll vendor will implement the best cybersecurity tools and practices to keep your data secure.

• The software does it all:

The payroll software will be an end-to-end system that executes all operations on a single platform. For instance, the payroll management system will help to track attendance, calculate the inputs, evaluate the performance, and process the payroll through a single window. Hence you do not have to rely on many resources to complete administrative tasks.

• Save finances:

The cloud based payroll software is an economic solution for business owners. Because you do not have to invest in huge IT infrastructure or team with the SaaS vendors. Additionally, they also take care of the maintenance and the payroll management system. It is a perfect tool for every business owner irrespective of their size to save money optimize your payroll process and manage expenses.

• Automated tax processing:

Tax management is an intricate and complex task that every business has to execute efficiently. The best cloud based payroll software will help businesses calculate the taxes as per the employee earnings and pay it to the right authorities before the deadline. The top payroll software in India will track the changes in the tax system compliances and notify you.

• Enhanced productivity:

As discussed earlier, the best payroll software will automate your entire payroll administration and processing. Because your employees can execute complex payroll tasks within a few clicks on the payroll software.

As a result, the human resources department can save their work burden and time to focus on the real challenges. A highly efficient and productive workforce will help you to achieve organizational payroll goals quickly. Even an employee monitoring system module will help you to track the efficiency of the workforce to calculate productivity.

• Reliability and scalability:

The online payroll software is a reliable, scalable, accessible, and affordable solution for all businesses. They have the best customer support and development that will ensure the system is up and running always. Moreover, the payroll management system is such a flexible tool that will adapt to your business process and grow with it.

The top payroll software is a beneficiary tool for all business types, sizes, and industries to calculate and execute their payroll operation efficiently. The top payroll software in India vendor will allow you to customize the solution to personalize the benefits for your organizational goals.

Who Uses a Cloud Based Payroll Software?

The cloud based payroll software is more of a necessity for large-scale and medium-sized businesses that employ a large number of workers. It is also important for companies that hire third-party, temporary freelancers as well as permanent and full-time workers. payroll management systems come in handy when it comes to handling the mix of traditional workers and gig workers. But, the question is 'Do you even need a cloud based payroll software solution?

Well, if your firm pays a couple of independent contractors, then this software isn’t needed. All you have to do is write them a paycheck or send their payment by direct deposit. The reason is quite simple – companies are not responsible for deducting their taxes. So, you don't need a payroll solution if you work with a few independent contractors.

On the other hand, companies that pay salaries or wages to their employees need a payroll management system. Some business owners need to pay themselves the monthly salary as an employee of the organization.

So, if that is the case, you are supposed to hire an HR team and install payroll software to automate the calculations. Only independent contractors are responsible for paying their taxes themselves. If you are still not sure, talk to an income tax advisor and discuss it with them.

If you are still using a traditional payroll management system we have pointed out the reasons to upgrade the cloud payroll Software.

Why Do You Need a Payroll Software in India for Your Business?

SMEs do not pay attention to the risk of potential human errors that could hurt the payroll process, employees, and the organization as a whole. An effective payroll software in India can help reduce manual errors to a great extent.

Here we've mentioned a few important reasons why you need a payroll management system. Every organization needs payroll software in India, here is how it Improves the payroll process.

1. Efficient Use of Time:

Companies spend hours working on payroll processes. Issuing paychecks, calculating the right amount, deducting income tax & benefits from the net payment, and generating accurate HR reports are some of the tedious and time-consuming tasks.

Using an advanced payroll management system in India can save you time in calculation. It automates the whole payroll procedure and saves countless hours you would otherwise spend on tax preparation.

2. Reduce Errors:

Miscalculations are a part of manual errors. Not only do these errors lead to penalties, but they can wreak havoc in your payroll management system.

3. Customizable:

You can customize the payroll management software according to your firm's requirements. It can be customized according to the pay structure of your organization. This reduces your burden of checking if all the conditions are fulfilled when issuing the paycheck.

4. Employee Access:

Employees get the opportunity to view their payment records, the salaries of other employees, and benefits. This promotes transparency in payment. Furthermore, it boosts your employees’ morale and encourages them to work harder.

5. Easy Integration:

To lower the management pressure, you can integrate different apps and software with the best payroll management software in India. It streamlines your business operations by linking different departments to the payroll management system.

Types of Payroll Software for Different Businesses

Different types of payroll software are available for different businesses. Depending on the nature and type of your firm, you can opt for an Enterprise-level payroll solution or the software for self-employed payroll processing.

• Payroll for Enterprises:

You don’t want to buy high-priced and premium software only to discover that it doesn’t cater to your business requirements. Unlike regular payroll processing software, enterprises need a high-quality and advanced system that can cater to the varying requirements of the business.

The major challenge for such businesses is the switch from older and traditional models to a new system. It might be difficult for employers to train their workers and make them familiar with the new payroll software.

• Payroll Software for Self Employed:

Self-employed workers are supposed to file their returns every year. You don’t get your payment after-tax deduction. It is something you have to do on your own. As a self-employed individual, you must be getting your payment as salary, dividend, and other distributions.

Depending on your state and federal tax laws, the income tax percentage can vary by region. It is best to purchase quality payroll software for small businesses and leave the calculation to the software.

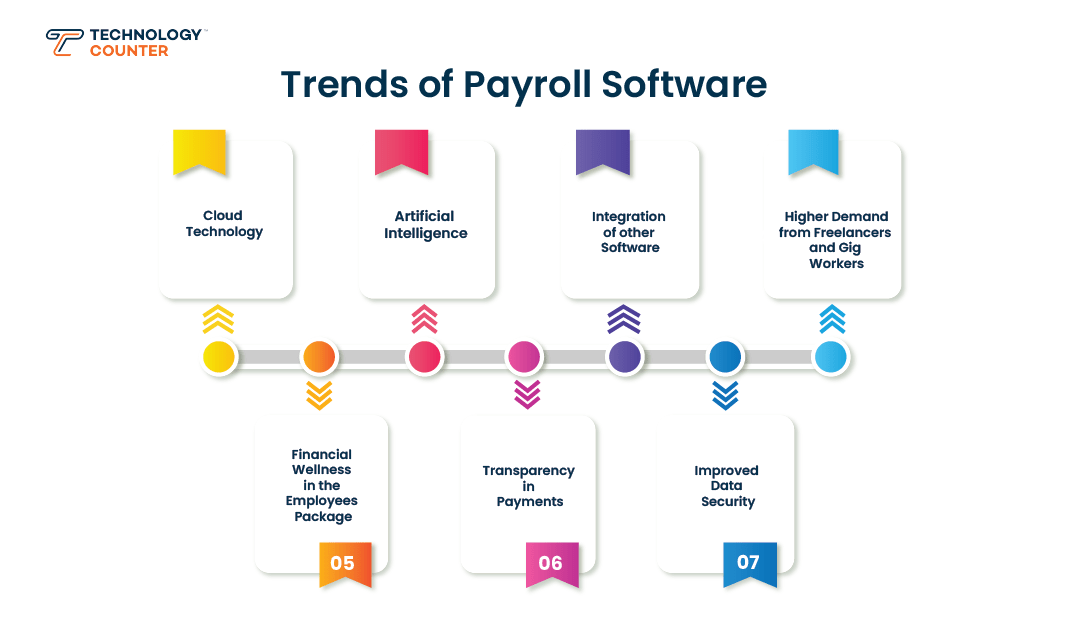

Payroll Software Technology Trends

Do you know that 40% of SMEs have to pay payroll penalties annually? These penalties are imposed on businesses that do not pay their returns on time or file errors. The news doesn’t come as a surprise since payroll calculation is super difficult.

It is not just a monthly salary, but you have to consider several factors such as employee incentives, benefits, and tax deductions. What makes it even more complicated is the fact that each state has its own federal and state laws regarding tax deductions and employee wages. You don't want to add tax penalties to your business expenses.

As technology is growing, new trends keep emerging in the payroll industry. Payroll processing software has gotten better over time. In this section, we will walk you through the latest payroll software trends that every business must know. Let's get started.

• Cloud Technology:

Businesses have already started to embrace cloud based payroll software. Cloud-based systems enable users to gather data from any device.

This system is mainly useful for HR departments that work from home. Now, accountants and managers do not need to visit the office. The software enables employees, supervisors, HR members, and staff to collect real-time information about their salary, leaves, and overall performance.

The on-premises payroll management system is not only difficult to install, but it comes with a higher risk of getting hacked. So, businesses have to spend hundreds of dollars on the security of the on-premise payroll system software to ensure that their data and confidential business information are safe.

Even you can protect your employee data during tax Season. Cloud based payroll software, on the other hand, is easy to set up. It doesn't need a security system as only the employer has the right to grant software access to other employees and HR members.

• Artificial Intelligence:

Movies have made it quite normal for people to think that artificial intelligence and bots will take over humans in the future. Well, it is true to some extent. In certain industries, robots have started to replace workers.

Technology has also played a vital role in the payroll industry. Earlier, payroll was a simple process. It involved the calculations of the employee's monthly salary or wages and issuing a paycheck. The manager would prepare a general report. That's it! But, that's not the case today.

The payroll is revolutionizing. There is no doubt Artificial Intelligence has changed the way employees are paid. Nowadays, companies have started to pay employees based on their worked hours, productivity, and their contribution to the company’s growth.

Moreover, businesses need to gather and analyze a significant amount of payroll data. The annual payroll data can provide you with an insight into the employees' expenses, the company's budget, and the growth of the firm. Another advantage of artificial intelligence in the payroll management system is the chatbot. Now, HR managers can ask chatbots their non-urgent questions instead of contacting the employees or disturbing the manager.

• Integration of other Software:

While HR management and the payroll process are two different concepts, they are connected. If you link your HR technology with payroll management software, you will be able to access a vast amount of information from a single, user-friendly dashboard. The major benefit of linking HR technology with payroll is the efficient management of employee data.

HR solutions help you with employee tracking, accounting, employee productivity management, and more. If these two systems are integrated, it becomes super simple for managers to share employee data across systems. This also ensures that no employee is overpaid or underpaid. The time and productivity of your employees are tracked and recorded accurately in HRM software and the payroll management system.

When you get access to data in a single system, you can generate actionable insights and compensate your employees accordingly. This integration allows managers and HR departments to collect personalized reports of their employees.

• Higher Demand from Freelancers and Gig Workers:

The growth in technology has resulted in a rise in the number of freelancers. As technology enables people to work remotely, many people have started to work as freelancers. There has been a shift from full-time employees to third-party workers. While it is quite convenient for freelancers to work from home, this has made things quite complicated for old businesses.

Handling the dynamic workforce is a major challenge for old and traditional firms. An efficient way to manage full-time or permanent employees and freelancers is the payroll software. Now, tracking the number of hours the freelancers have worked is super easy with the best payroll software. You can gather information regarding their worked hours, productivity, and performance. This allows you to issue their payments on time.

• Financial Wellness in the Employees Package:

There is a strong connection between employees’ retention rate and satisfaction rate. The more you keep your employees satisfied, the better their performance will be. Most employees find it difficult to focus on work with the mental stress and the tension of their financial well-being. Too much stress can lead to physical and mental health issues.

To get your employees to perform their best, you need to reduce their financial stress and boost their motivation. That is the reason why payroll software developers have started to integrate financial wellness programs into the software.

Financial wellness programs offer financial counseling to your employees and some tips on where they should allocate their money to save for retirement. It also provides them with the best guidance for their retirement plan.

The program might not increase their salaries, but it is a great way to motivate your employees and guide them in the right direction. There is a good chance the workers will spend more time focusing on work rather than stressing over their financial well-being.

• Transparency in Payments:

More and more businesses plan on making salary and wage-related information accessible to employees. Gone are the days when only people at high posts were allowed to access the employees' reimbursement details. Today, companies have started to provide even part-time workers access to the payroll management system. The companies take this step to clarify their pay structure.

There couldn’t be a better way to boost your employees’ morale than by allowing them to know how you distribute payments among employees. This gives them the idea of ‘why they are paid what they are paid’. It promotes a sense of equality and fairness among your workers.

This also encourages your employees to perform their best. By allowing your employees to access the solution and get a glimpse into the salary disbursals structure of the company, you eliminate the unbiased treatment among your workers.

• Improved Data Security:

The new regulations have made it mandatory for the payroll software to be GDPR compliance. This ensures that the confidential or sensitive data you update in the system will be protected. Companies have a large chunk of confidential information that needs to stay between the employees and the firm. This includes their wages and salary, personal details, bank account numbers, and social security numbers.

The payroll management system is designed with dual authentication security features. Only people who are given access to the software can log into the software and access the data.

How to Choose a Payroll Software for Your Organization?

Now that you have finally decided to install the payroll management system, it is time to start researching and finding the best payroll software vendor. An ideal payroll software software fits your business requirements and offers features that can benefit your organization in the long run. You need to look for a system that streamlines your payroll processes and helps you issue paychecks on time.

Moreover, you must be able to access the software anytime and anywhere. We have made an overview of everything you need to know before buying the best payroll management software.

So here are a few things you must consider when selecting payroll software for your business.

-

Does the package include other services, such as HR, attendance, benefits, advanced reports, and more?

-

What payroll taxes are included in the system?

-

What price structure does the vendor follow? Remember that some vendors use a price-per-worker format, while others charge monthly subscriptions.

-

Does the payroll management system provide you with real-time insight into the employees' data?

-

Do you need to be chained to your desktop to access the payroll management system or is the software compatible with multiple browsers and devices?

-

Can you customize the payroll processing software according to your firm and employees' requirements?

-

Does it offer a self-service feature for employees? Will they be able to access the information about their wages or salary, deductions, and other details?

-

Is the software easy to install and use?

-

Does the vendor offer high-quality and round-the-clock customer support service? Do they look into the technical issues?

-

Last but not least, what kind of security features does the system offer?

Before you purchase payroll software software, make sure to get the answers to the above-listed questions. You don’t want to buy a subscription for an expensive solution that isn’t compatible with smartphones.

Research the latest payroll management software on the internet and choose the most suitable one. Remember to discuss the features and installation process with the vendor before sealing the deal. Remember that all the online payroll software vendors offer free trials for their best products.

Find Out How Payroll Software Can Help Your Business

Seeking more information about payroll software? Explore these essential resources to gain valuable insights and make informed decisions:

- Steps to a Successful Payroll Implementation

- How Will Blockchain Revolutionize The Payroll Process?

- 7 Tips for Efficient Payroll Management

- Top Reasons to Upgrade Your Traditional Payroll to Cloud Technology

- Demystifying Common Payroll Stereotypes

- Top 5 Free Payroll Calculators

- RazorpayX Payroll - Automated Payroll, Attendance, Salary Insights & Reports

- What Are the Challenges of Managing Payroll for Remote Employees?

Final Thoughts & Recommendations

hoosing the right payroll software depends on your business size, compliance needs, and budget. Here’s our final recommendation:

✅ Best Overall: Keka – Scalable and feature-rich.

✅ Best for Startups: Zoho Payroll – Affordable and easy to use.

✅ Best for Compliance: Saral PayPack – Strong PF, ESI, and tax automation.

✅ Best for AI-Driven Payroll: Qandle – AI chatbot and automation tools.

Still unsure? Request a free demo from the top providers before making a decision.

Need expert guidance? Explore detailed software comparisons on TechnologyCounter!